#Sequoia Capital

Quick Peek

- “The creative spirits. The underdogs. The resolute. The independent thinkers. The fighters and the true believers. This ethos describes the founders we partner with, as well as Sequoia’s relentless drive to help them succeed.”

- “Many of our most promising companies have chosen to stay private longer, building scale and expanding their strategic footprint before debuting as public market leaders. They then compound their advantage for decades, with much of their value accruing long after an IPO”

→ Patience, Long-term partnership

Founder(Don Valentine) named sequoia due to its longevity and strength. “He wanted a partnership to outlive him with a lot of consequent behavior and actions. He wanted us to invest in companies that stand the test of time”

Door Dash went public on Dec 10, 2020. Let’s dive in and see what Sequoia discovered and anticipated about this company.

- Introduction

(DD website) “DoorDash (NASDAQ: DASH) is a technology company that connects consumers with their favorite local businesses in more than 30 countries across the globe. Founded in 2013, DoorDash builds products and services to help businesses innovate, grow, and reach more customers. DoorDash is your door to more: the local commerce platform dedicated to enabling merchants to thrive in the convenience economy, giving consumers access to more of their communities, and providing work that empowers.”

So yeah, the “local commerce platform”, “enable merchants” are the 2 key concept.

DoorDash pitched their strength in 1) Sticky product with very strong top line performance, 2) 20% contribution margin without optimization, 3) Defensible business with strong 3-sided network effects (Customer-Merchants-Drivers)

Sequoia agreed, “Until perhaps consumers reach their limit of takeout food from restaurants, all of this suggest a very sticky business where returning users continue to spend more and more. GPV for returning customers by cohort started from $100→$200

In the Business Diligence section, GPV(Gross Processing Volume), annual revenue return rate, Stacked revenue by cohort. GPV = Order Volume+Commission + Delivery Charge + Drivertip ($10M annual run rate). Considering the GPV by cohort and the Customer Repeat rate, it proves great retention and growth.

*There are 2 more redacted indicators that we don’t have access

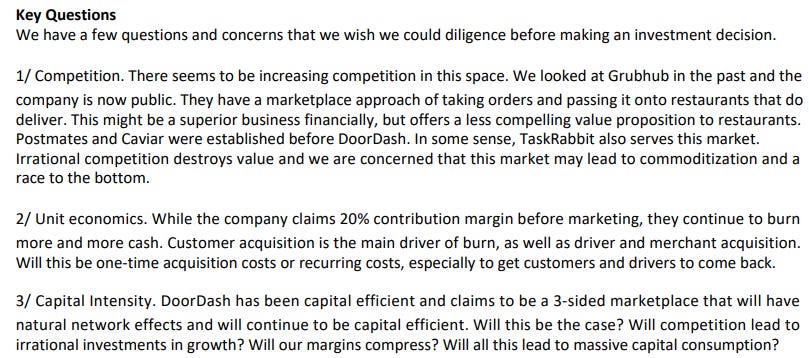

Pre-Parade & Pre-Mortem framework (Best Case & Worst Case in 3-5years)

To check “If everything goes right” these are the list of questions they had.

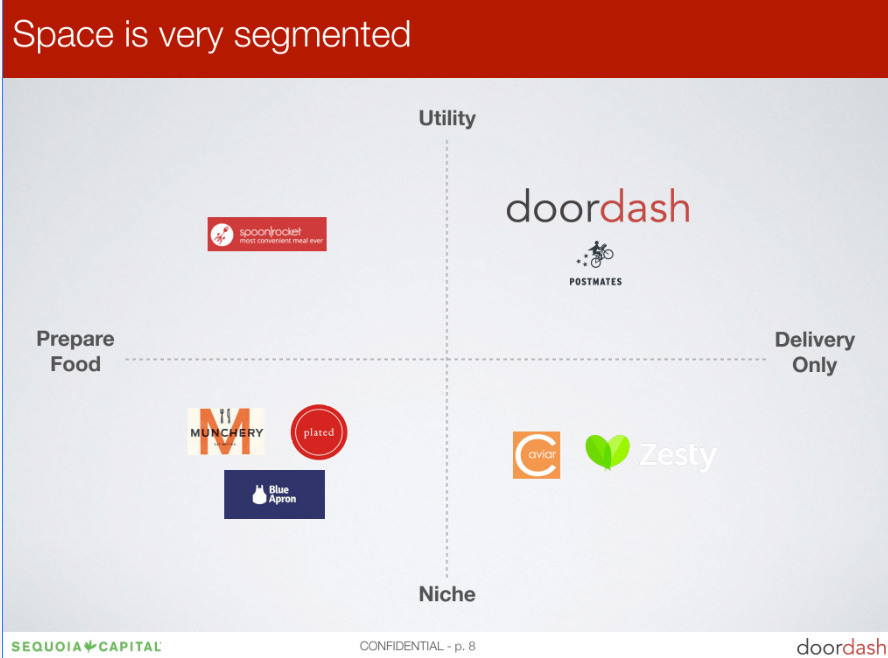

- Main questions align with the challenges with most of the food-delivery companies had : Unit economics and Competition

In the Team section, “They raised 2.4M and still have $1.7M in net cash” → proved capital efficiency. Net cash = Cash on hand + restricted cash - net future payments to drivers+merchants

Resilience gets results (Door Dash)

“DoorDash wasn’t the first food delivery service, but they had clear vision and an ability to execute better than the competition. Tony made me a believer and I came to see the unique attributes that would allow DoorDash to come from behind and lead what could be a very large market.”

- Food Delivery was booming, everyone was jumping in. DoorDash stated they had a different approach, fast service, lower CAC, Higher unit economics. We’ll look through how they made their growth and survived the war next time.

Thousands of competitors are still out there.

As of now, who is winning? Did Sequoia make the right choice?

#History of food delivery companies

!Fun fact!

Before Caviar was acquired by DoorDash($410M, Aug 2019 ) it was in the hands of Sqaure. Caviar’s premium restaurants (complementary strategic position) ,leading technology+ Team were also considered. Square and DoorDash also had a partnership: 1) DoorDash was integrated with Square for Restaurants point-of-sale, 2) Cash Boost (Reward app that works with Square’s Cash app) provided instant reward to customers who use their cash cards with delivery service.

- In 2018, GrubHub and Seamless had the largest MS (50%+) . In 2019 the Big 4 were Postmates, UberEats, GrubHub/Seamless, DoorDash+Caviar(Door Dash <-> Caviar Acquisition).

- Postmates got $100M with valuation of $1.85B (Series F) around Jan 2019, then were preparing to go public. Uber acquired Postmates in 2020.

- DoorDash has raised $40M at $595M(March 2015, round B) , $127M at $700M ( 2016, round C), $535M at $1.4B (March 2018, round D) , raised another $250M at $4B(Aug 2018, round E), then was planning on raising another $500M at $6B, but managed to get $400M at $7.1B valuation. (Feb 2019, round F) $600M with valuation of $12.6B (May 2019, round G).Boom!

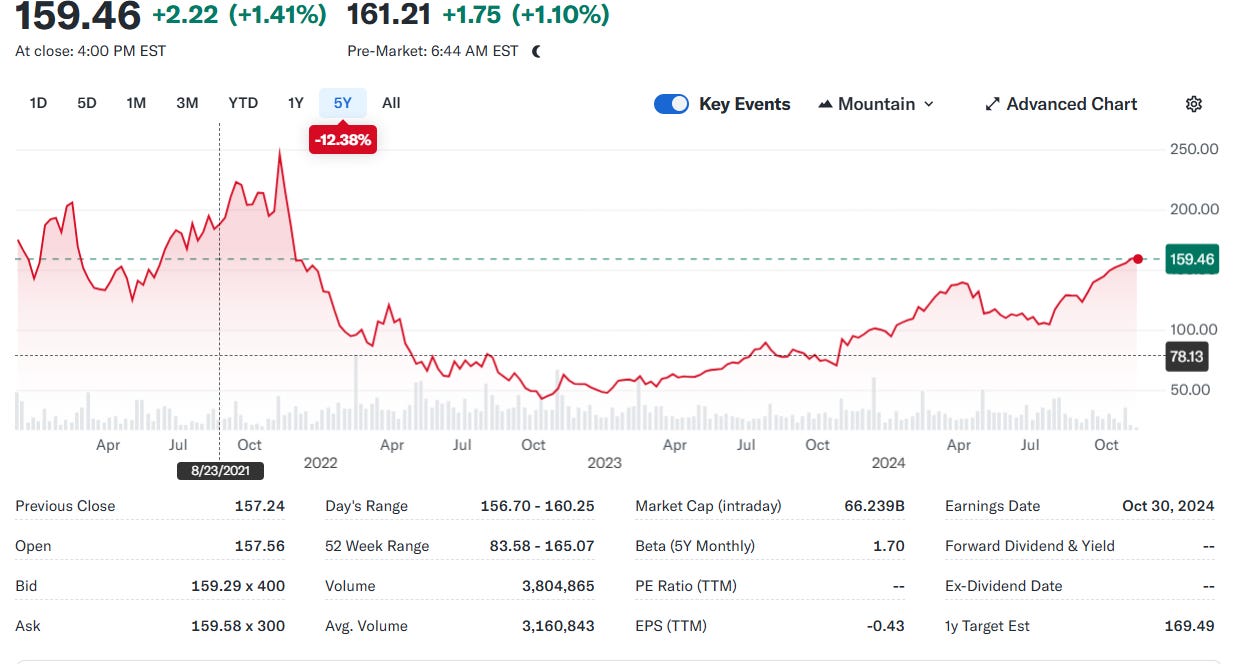

-DoorDash had a rough time after COVID, but hey they are still the #1 in the market!

*SpoonRocker (Meal Delivery Service) crahsed with 13.5M raised in 2016. Eat24 was acquired by Yelp.

* Sequoia China’s previous attempt on food delivery was in 2006, $2M series A

Related Links

- Door Dash IPO (NY Times)

- Investment Memo Original Version Tweet

- Analyst's Opinion after IPO (Yahoo Finance)